By the numbers: Payrolls fall short of forecasts

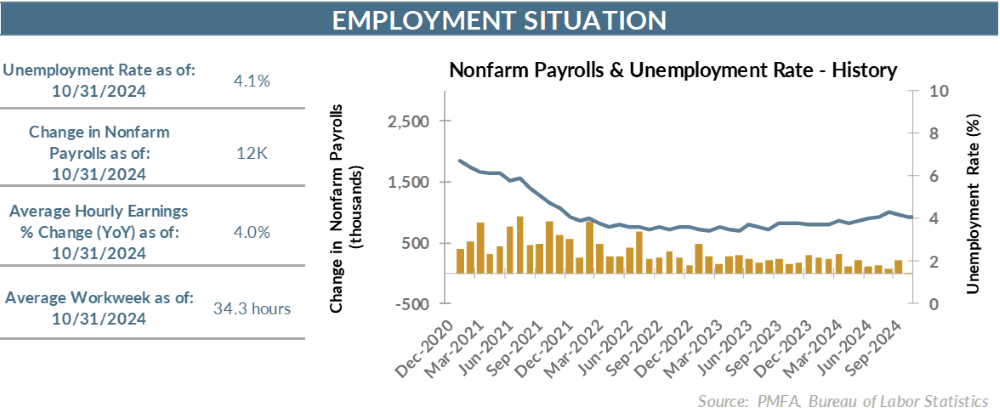

• Unemployment held steady at 4.1% in October, despite a sharp decline in the number of employed individuals in the monthly household survey.

• Employers confirmed the weakness reported by individuals, as payrolls posted a lackluster 12,000 increase for the month. Tacking on to that was the 112,000 reduction in previously reported payroll data for a net decline in payrolls of 100,000 from the September report.

• Against forecasts for a payroll gain of 110,000, the result was a big miss, even if the likely reasons were widely understood.

• Falling job openings and the return to a more normalized hiring environment has also taken some of the heat out of wage growth, although average hourly earnings were effectively unchanged at just shy of 4% over the past 12 months.

The least concerning “weak” jobs report you could get

• The attention-grabbing piece of the jobs report is the payroll numbers, as job creation ground to a virtual standstill last month. The downward revisions to the preceding two months added insult to injury.

• Weaker payroll growth can be traced back to the Boeing strike and two hurricanes that pounded the southeast United States last month, both of which were significant enough to easily move the needle on national employment figures. An estimated 12 million workers were impacted by the storms.

• Both are temporary factors that should wash back through positively in the November jobs report. Further, the cleanup and rebuilding process across the impacted region should provide a boost to construction hiring for some time to come.

• A broader swathe of employment data still paints a relatively positive picture; current conditions are both understandably and necessarily weaker than the go-go environment of a few years ago, but still quite constructive and reflective of an economy that remains on a solid growth trajectory.

• Below the surface, there were no notable areas of strength in private sector hiring last month, although the service sector held up better than manufacturing, which posted a decline of 46,000 jobs. The overwhelming majority of those job losses were in the transportation sector, undoubtedly reflective of the impact of the Boeing strike, although automotive sector weakness also played a role.

• The report was at best a mixed bag, with unemployment holding steady despite virtually no job creation last month. In the absence of exogenous factors, it would raise significant concerns about economic momentum. In this case, those shocks are easily identifiable and explain the disconnect between a weak employment report and the strong Q3 GDP numbers released earlier this week.

Labor data holds nothing that should sway the Fed

• Given the noise in the October jobs report and underlying causes, its impact on Fed decision-making is likely to be minimal.

• Policymakers have already teed up a quarter-percent rate cut for next week, and still appear well-positioned to deliver on that expectation.

• Broader indications of the state of the labor market remain constructive. Fed policymakers have been looking for a goldilocks path toward normalization, which required a cooling in labor demand without a collapse. Thus far, the trend still appears to be on track.

The bottom line: Soft, but explainable

• The bottom line? The October jobs report was softer than expected, but not terribly concerning given the one-two punch of the Boeing strike and Hurricanes Helene and Milton.

• Other labor market data remains relatively solid, likely setting up payrolls for a strong rebound in November.

• Despite the volatility in the payroll numbers, the economy remains on a solid footing. Growth remains above trend, labor conditions continue to normalize, and the disinflationary trend remains intact.

• The Fed still appears to be set up to cut by another quarter point as expected next week and reaffirm prior guidance for further cuts ahead, subject to continued progress toward the central bank’s dual price stability/full employment mandate.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.