By the numbers

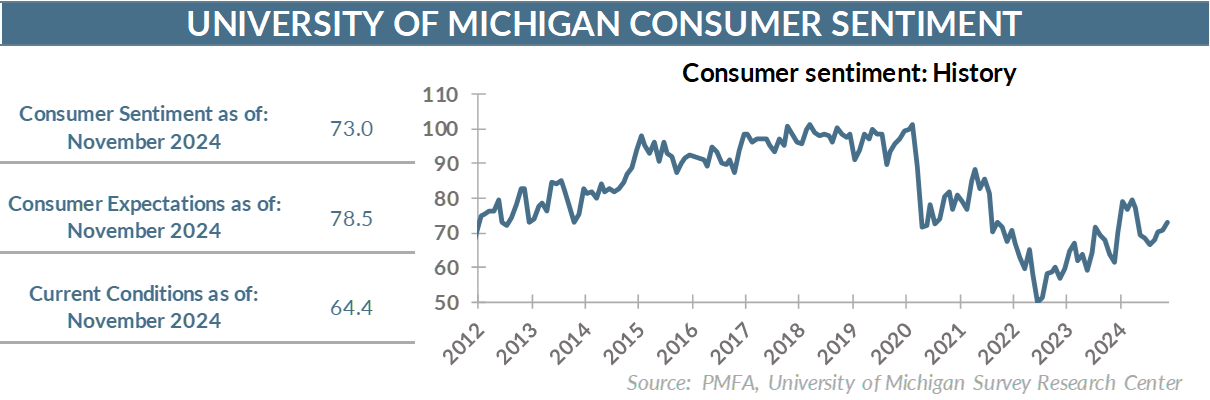

• How do consumers feel? They’re still not enthusiastic, but they’re growing more upbeat in their assessment of the economy. The University of Michigan Index of Consumer Sentiment rose to 73.0 in November, up from 70.5 in the final October reading, reaching a seven-month high.

• The story wasn’t one of universal improvement though. Consumers were slightly less rosy in their assessment of current conditions, despite becoming more optimistic about where the economy is headed.

• The reading is well below this year’s high of 79.4 in March and below the 20-year average of 80.4. Even so, the index rose by nearly 20% over the past year.

Broad thoughts

• The underlying consumer mood is still measured, but it’s improved considerably over the past year, aided by diminished recession risk, a considerable slowdown in the pace of inflation, and solid labor conditions.

• On the surface, the relatively constrained consumer outlook seems surprising coming off another solid quarter of above-trend growth, fueled by brisk consumer spending.

• From solid, albeit cooler, labor market conditions to lower interest rates and inflation measures that continue to slow toward 2%, one might expect consumers to be a bit more upbeat than they are.

• Still, the fact that the pace of inflation has cooled doesn’t translate to falling prices or more discretionary income. Consumers continue to feel the pinch of prices that rose sharply in recent years, with the impact particularly acute among lower income households who’ve seen their discretionary spending dwindle to pay rent and buy groceries.

• Food and housing saw some of the largest price increases in recent years and already represented a disproportionately large part of spending budgets for lower income households. That’s only become more exacerbated in recent years.

• That reality weighed heavily on the minds of many voters as they headed to the polls last Tuesday, with exit polls suggesting that the higher cost of living played a significant role in the election’s outcome.

• The survey does hint at some glimmers of optimism though, with more Americans expecting to be in a better financial position six months from now than they are today and an increasingly upbeat view of business conditions.

• Perhaps most importantly, there’s been a notable disconnect between what consumers are saying and how they’re spending. Consumption growth last quarter was brisk, lifted by a sharp and long-awaited rebound in spending on goods.

Looking ahead

• It’s important to note that the survey was completed before Tuesday’s election, so the results aren’t reflected in the first reading on November sentiment. In recent months, there had been a divide in the relative mood of some respondents that reflected their political views. Those self-identifying as Democrats had been a bit more optimistic in their outlook, while those leaning Republican expressed a higher degree of pessimism.

• It’s too soon to determine the degree to which the results of the election might impact future surveys, but a reversal in those views is likely. That could provide a bit of a boost in the next few index readings, assuming the composition of the pool of respondents is relatively in line with the voting public.

• Additionally, the Fed’s reaffirmation of further interest rate cuts in the pipeline should ease borrowing costs in the coming months. That will benefit households at least at the margins, although the outlook for mortgage rates is unclear, as they’re not tied directly to short-term rates.

• Finally, recent strength in the stock market could provide a boost of confidence as investors see growth in their retirement assets.

The bottom line?

• Consumers have moved away from the extreme pessimism of two years ago, as the lingering effects of the pandemic were dissipating, but households were dealing with the one-two punch of high and rising inflation and fears of a coming recession.

• Further, they may not feel exuberant, but they’re spending in a way that would suggest a greater degree of confidence than the current state of the sentiment index indicates.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.