As discussed in our accompanying piece, volatility tends to spike in the month or so prior to the election, as concerns around the election outcome peak. After Election Day, however, volatility tends to fall precipitously as investors adapt and refine their expectations in response to its outcome.

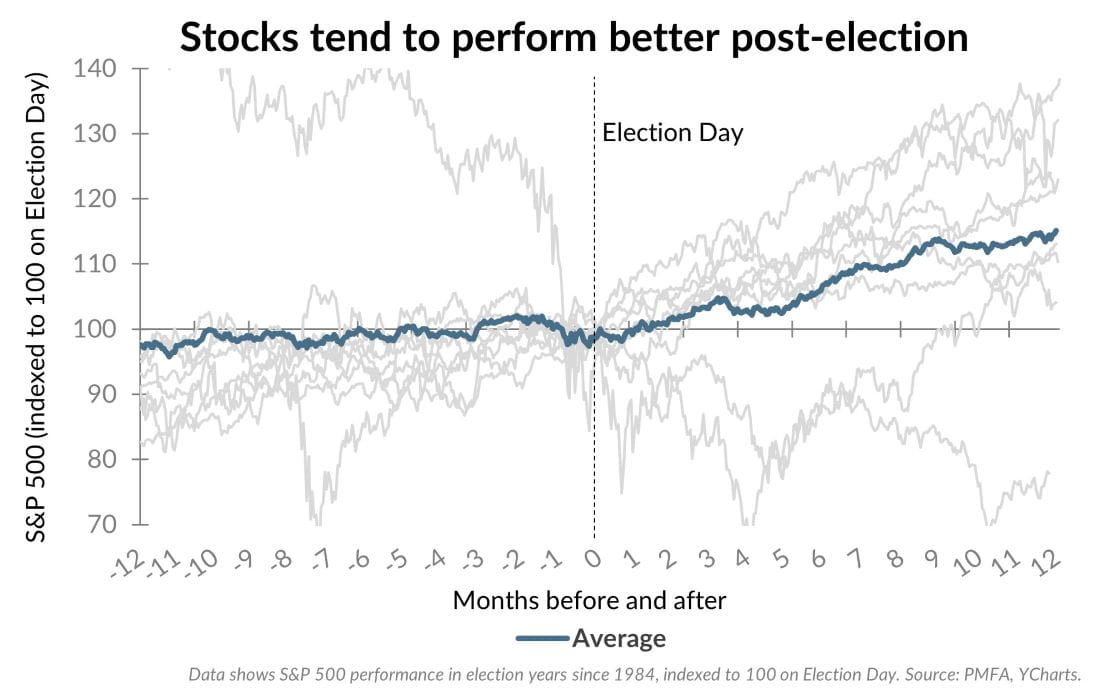

But how do equity market returns tend to react around elections? As shown in the chart above, stocks (as measured by the S&P 500 index) have, on average, produced positive, though somewhat choppy returns in the 12 months leading up to Election Day. After the election, however, a marked shift can be seen in most instances. Once election uncertainty abates, markets tend to experience a solid rally that generally extends well into the following year. The two notable exceptions were in 2000 and 2008, as recessions and steep bear markets occurred, neither tied to the election itself.

Outside of those two periods marked by recession and severe bear markets, the pattern of solidly positive performance in the 12 months following elections has been remarkably consistent. In fact, in nine out of the 10 election cycles since 1984, stock market performance has been solidly positive at the end of the 12-month period post-Election Day, even including the 2008-2009 period on the strength of the recovery following the Global Financial Crisis.

While volatility can be unpleasant to live through, investors shouldn’t let election uncertainty divert them from their long-term strategic plan.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.