On March 6, 2024, after two years of deliberations, the SEC adopted its final climate-related disclosure rules requiring registrants to disclose specific climate-related information in their reporting. Although not as rigorous as the original proposals issued in March 2022, the final guidelines represent a significant juncture in how public companies — and, by association, many private companies — will need to report climate-related information in the United States.

Some of the key considerations for public companies include:

- Greenhouse gas emissions reporting

- Scope 1 and 2 disclosures are required, only when deemed material, for large accelerated filers (LAFs) and accelerated filers (AFs).

- No Scope 3 disclosures are required.

- Attestation

- Limited assurance of Scope 1 and 2 disclosures will be required for LAFs and AFs three years after filing their first emissions report.

- Reasonable assurance for LAFs will be required seven years after the first filing.

- Climate-related risk reporting

- Climate-related risk disclosure starts as early as 2025 for LAFs.

- Climate-related risk disclosures are largely in line with the Taskforce on Climate-Related Financial Disclosures (TCFDs) and include:

- Any climate-related risks that are reasonably likely to have a material impact on the registrant’s business strategy, results of operations, or financial condition.

- Potential and actual material impacts of these climate-related risks.

- A quantitative and qualitative description of the material expenditures incurred related to building and implementing a strategy to mitigate or adapt to climate-related risks.

- Any governance oversight for handling material climate-related risks.

- Any transition plans, scenario analysis, or internal carbon prices used to mitigate or adapt to material climate-related risks.

- Any climate goal or target that is material to a company’s business, results of operations or financial condition.

- Financial statement disclosures:

- The capitalized costs, expenditures expensed, charges, and losses incurred as a result of physical climate risks, like severe weather events, at a threshold of 1% of pretax income or shareholders equity, subject to de minimis thresholds.

- The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy certificates if material to the company’s plans to achieve its climate-related goals and targets.

- These items, in combination with the impact severe weather events and other natural conditions can have on estimates and assumptions used within the financial statements, are required disclosures subject to audit procedures performed by an independent registered public accounting firm. They’ll also be subject to internal control over financial reporting, requiring management's assessment and certification and generally auditor assessment as well.

- Registrants will not have to share their climate-related opportunities.

- There is an accommodation for companies to report their emissions for a year in their 10-Qs for the second quarter of the following fiscal year to give them time to collect data.

Additional details are available in the SEC’s fact sheet or the full 800-page final rule. (Downloads in .pdf format).

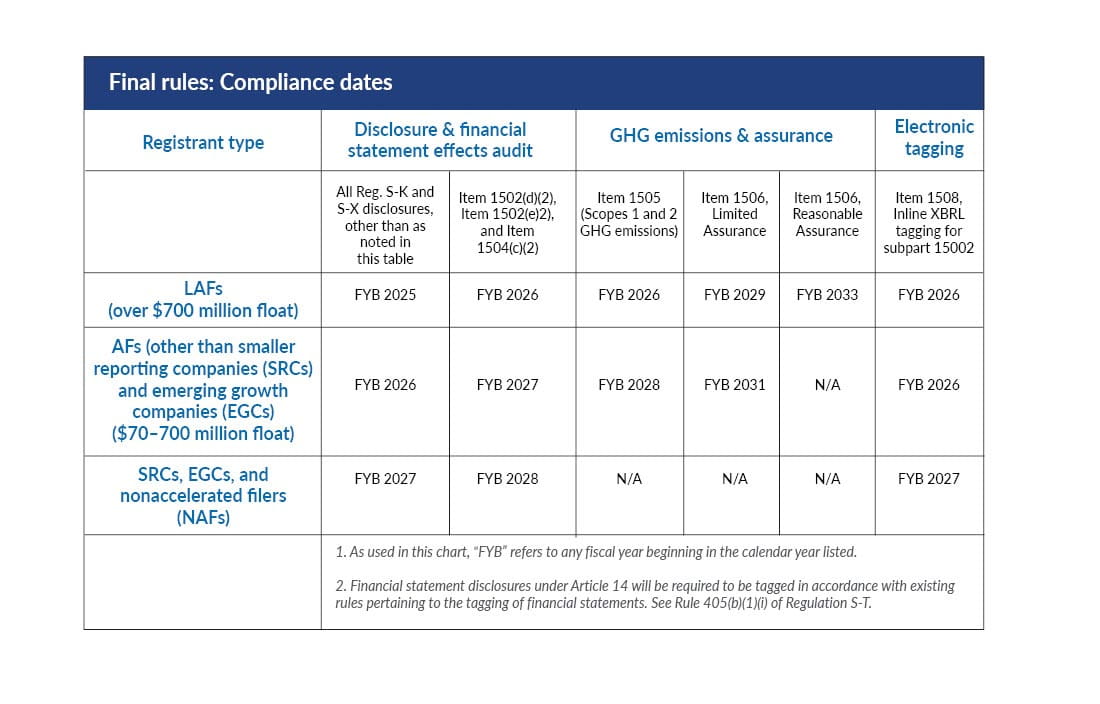

The final rules will be effective 60 days following publication of the adopting release in the Federal Register. Compliance dates will be phased in for all registrants based on filer status in accordance with the table below.

As shown above, the effective reporting dates were scheduled to begin as early as 2025 for some companies. However, it should be noted that the SEC has stayed implementation of the rules while court challenges play out. The court action, along with upcoming federal elections and the possibility of congressional actions, leaves uncertainty around implementation and timing.

The path ahead

Given the current state of uncertainty, what should you do? Regardless of near-term uncertainties, it’s critical that — whether you’re a public or private company — you review these new SEC disclosure requirements, including GHG emissions reporting and assurance requirements, and understand how they may apply to your operations. In addition, it’s important to consider the overall momentum that’s building toward climate-related disclosures, whether mandatory or voluntary, and what actions make sense for your company aside from the issue of regulations. It’s also important for companies to weigh any threats that climate-related risk may pose to business continuity.

Considerations for private companies

If you’re a private company, the new SEC climate-related disclosure rules don’t apply directly, but there are clear implications if you have business relationships with public companies; they may require information from you to include in their disclosures, or you may need to provide them for market or competitive reasons.

If you’re a private midmarket company, consider the following scenarios:

- Impacts based on business relationships with public companies: It’s anticipated that public companies may increasingly measure their Scope 3 emissions for regulatory and commercial reasons. If you’re in the supply chain of one of these companies you may be required to disclose when a climate-related risk materially impacts or is reasonably likely to materially impact their business, operations, or financial condition.

- Influence on business practices and investor expectations: Regulations governing public companies will inevitably influence business best practices for private companies. As these practices become widespread, investors and stakeholders will gradually come to expect private midmarket companies to maintain similar climate best practices.

- Potential future regulation and IPOs: Understanding and voluntarily adhering to certain aspects of the SEC’s climate-related disclosure requirements can help prepare private companies for capital events such as a public listing.

- Commercial advantage: Proactive engagement in climate-related reporting can provide a competitive advantage to private companies by improving brand reputation and making them more attractive to investors, customers, employees, and other stakeholders. On the flip side, if your competitors are signing on to things that aren’t required by law (and you’re not), this may give them an advantage in the market that you can ill-afford to ignore.

- Compliance with laws of other jurisdictions: If your company does or may do business in California or with companies subject to California regulations, you may find you’re subject to additional environmental disclosure rules such as the recently passed California climate disclosure laws that apply to both public and private companies. Challenges to these laws are currently before the courts, but given the uncertainty, you should carefully consider and prepare for impacts in the event that they become law. Similarly, climate-related disclosure rules in jurisdictions outside of the United States can have a significant impact on private companies.

Decisions you make today should take into account these possibilities.

On the face of it, there may not be anything immediate you need to do in response to the SEC final rule, but now’s the time to evaluate your risks and uncover any impacts you’re not aware of.

Be clear on what you’re currently doing around climate-related disclosures and whether these efforts are being addressed in a proactive, thoughtful, and strategic manner. You may discover opportunities to prepare now so you’re ready to comply if asked to respond later. For example, do you know what IT systems house and integrate the data you’ll need? Can it be accessed for effective disclosures? What’s the integrity of the data? What are the internal control processes surrounding its accumulation and will they satisfy your customer or an auditor when third-party verification is required? If you aren’t collecting the data yet, or you’re considering upgrading your IT systems, now’s the time to address the eventual need for future disclosure requirements.

Climate-related disclosures: Tune in or fall behind

The march of climate-related disclosures continues on. The latest SEC rules confirm that rulemaking is becoming more direct and comprehensive for public companies, and if you’re a private company, the market forces can no longer be ignored.