First, the bottom line

- Despite rumblings of layoffs in some pockets of the economy, there’s little evidence of a broad-based increase in job cuts. Conversely, first-time claims for unemployment remain comfortably low and relatively rangebound.

- That’s not to say that there’s no tangible evidence of a marked cooling in labor market conditions — there is. However, that cooling hasn’t crossed the critical threshold into widespread cuts.

- For now, it’s a labor market that has largely normalized from the post-lockdown hiring frenzy, appears to be more balanced, and more closely resembles conditions leading into 2020.

- There are cracks, but they’re not significant enough to sound the alarm. That could change if last month’s weak payrolls report is followed by another for November. The next employment situation report looms large.

By the numbers

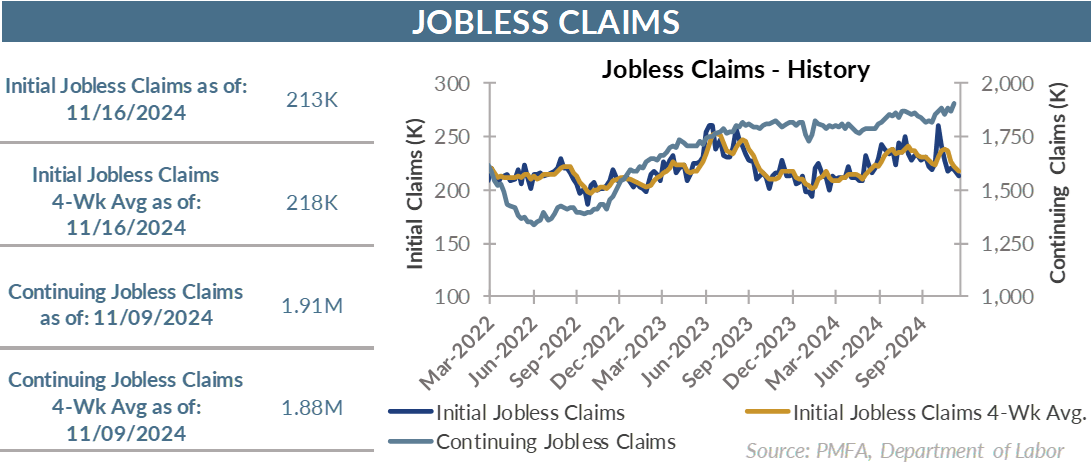

- Initial jobless claims declined last week, dipping to 213,000 for the week ended November 16 from an upwardly revised 219,000 in the week prior.

- Buffering against week-to-week volatility in claims data, the four-week average also declined moderately.

- Continuing claims rose to by 36,000 to 1.91 million from last week’s report of 1.87 million — a moderate increase, but one that extends the upward trend that has persisted since mid-2022, having bottomed around 1.34 million.

The takeaways

- The economy has shown remarkable resilience, led by household consumption that has become more balanced between spending on goods and services than had been the case for some time. The one-two punch of inflation and recession fears that weighed on consumer sentiment has largely dissipated, aided more recently by the Fed’s decision to start reversing its stack of successive rate hikes.

- Despite those risks to the expansion, strong hiring and wage growth provided fuel for growth in consumer spending, helping to perpetuate a virtuous cycle of spending, economic growth, and hiring.

- A combination of factors, including aggressive Fed tightening, has taken much of the wind out of the sails of the labor market since 2022. Job openings have fallen considerably, hiring has cooled, wage growth has eased, and fewer workers are voluntarily jumping ship in search of a different role.

- Add it all up, and there’s ample evidence that the froth in labor market conditions is dissipating.

- Despite a weak payroll number last month, hiring has remained on a solid path. There’s reason to believe that the tepid October increase in nonfarm payrolls was more anomalous than ominous, but the November jobs report will be a critical source of additional clarity.

- The fact that there’s been no discernible uptick in first-time jobless claims seems to validate that view.

- For now, the cooling appears to be just that — and one that was necessary to bring some balance to labor conditions and rein in inflation.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.