By the numbers

• The consumer price index edged higher in October, rising by 0.2%, in line with the aggregate forecast.

• Core inflation, which excludes more volatile food and energy prices, rose 0.3%, also in line with consensus expectations.

• On a trailing one-year basis, headline inflation rose from 2.4 to 2.6%, despite the relatively benign one-month increase. Over the past year, core inflation held steady at 3.3% — still troublingly above a range that would be palatable to policymakers and comfortable for consumers.

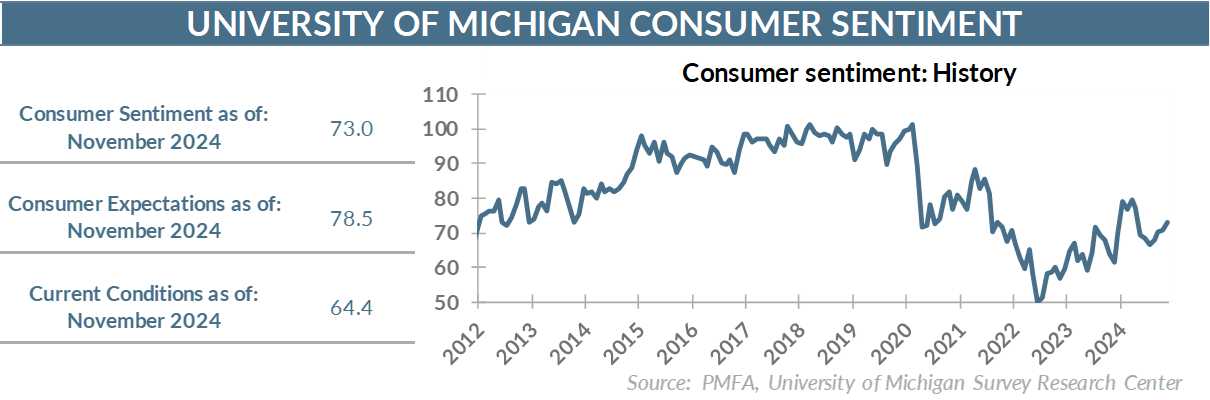

• Last week’s election results reflected many concerns on the part of voters, but few were greater than inflation. From a macro perspective, the economy may look good, but for individual voters — many of whom continue to struggle financially under the weight of prices that have risen sharply since 2020 — their personal financial situation feels very different and much less upbeat than the macro data would suggest.

Broad thoughts

• There’s long been a sense that the path from 9% back to perhaps 3 or 4% inflation wouldn’t be terribly difficult, which proved to be accurate. Many expected that the tougher slog was going to be the last steps back toward the 2–2.5% range on core inflation. That’s also proving to be the case.

• Solid labor market conditions continue to sustain consumer spending growth, keeping economic growth well above long-term trend and sustaining solid wage gains. The burden has also been eased by a decline in energy prices and much more manageable food inflation of around 1% over the past year.

• The bigger challenge is in the price of services, which continue to broadly increase at a pace close to 5%.

• Even with goods and energy prices deflating over the past year and food costs increasingly only modestly, outsized price increases in the service sector are preventing a more rapid return to a more benign inflation environment.

• Notably, housing costs continue to rise at a brisk pace close to 5%. The underinvestment in housing — affordable housing in particular – since the housing bust remains a challenge that isn’t likely be rectified through higher interest rates alone.

• With consecutive rate cuts now in the Fed’s back pocket, there is a broad sense that officials can view further easing through a more critical lens, particularly given the sustained positive momentum in GDP growth.

• Further, with the election now behind us, expectations for trade and fiscal policy have started to tilt toward the potential for stronger growth and higher inflation next year than had been anticipated previously.

• That doesn’t mean the Fed will suddenly reverse course, but it does mean that policymakers may reconsider the timing and pace of rate cuts next year.

The bottom line?

• Inflation continues to edge slowly lower, but the outlook for the coming year is far from clear. The potential for a backup has grown and could become exacerbated if the breadth and magnitude of President-elect Trump’s proposed tariffs become reality.

• The economy has continued to grow at a solid pace, lifted by a resurgence in consumption, raising doubts about the ability of or need for short-term rates to be slashed as aggressively as the Fed’s projections have suggested.

• The imposition of new tariffs by the incoming Trump administration may exacerbate inflation next year, but even in the absence thereof, further progress toward the Fed’s 2% bogey will be limited in the absence of a more pronounced cooling in the cost of housing and other services.

• The mathematical difference between 3% and 2% isn’t large, but the path to get from here to there still looks challenging.

• Consecutive 0.2% increases over time isn’t going to get the job done. The monthly numbers are better than they were, but even those aren’t enough to get to 2% and stay there.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.