Overview

The Federal Reserve (Fed) confirmed yesterday what market expectations had increasingly priced in over the past few weeks: that policymakers were finally ready to begin to reverse their aggressive inflation-fighting rate hikes with an outsized half-point cut. The size of the cut was important, but the Fed’s ability to manage the narrative about why they didn’t tiptoe into easing with a more traditional 0.25% decrease and what it means for the future path of monetary policy were even more critical.

The morning after

As the dust settles on what was the most widely anticipated Federal Reserve announcement in many years, there’s plenty to glean from the decision itself as well as the updated economic projections that accompanied the statement and Fed Chair Jerome Powell’s subsequent press conference. Generally speaking, the market likes what it heard.

Stocks surged in early trading on Thursday morning, a day after the Fed delivered a half-percent cut in its benchmark policy rate, lowering it to a range of 4.75-5.0%. In his press conference, Powell unsurprisingly cast a cautiously optimistic tone on the outlook, acknowledging the considerable progress made in beating back the inflation surge that forced the Fed into its most aggressive tightening cycle in decades. He also understandably stopped short of declaring outright victory, noting that inflation was still above the Fed’s target.

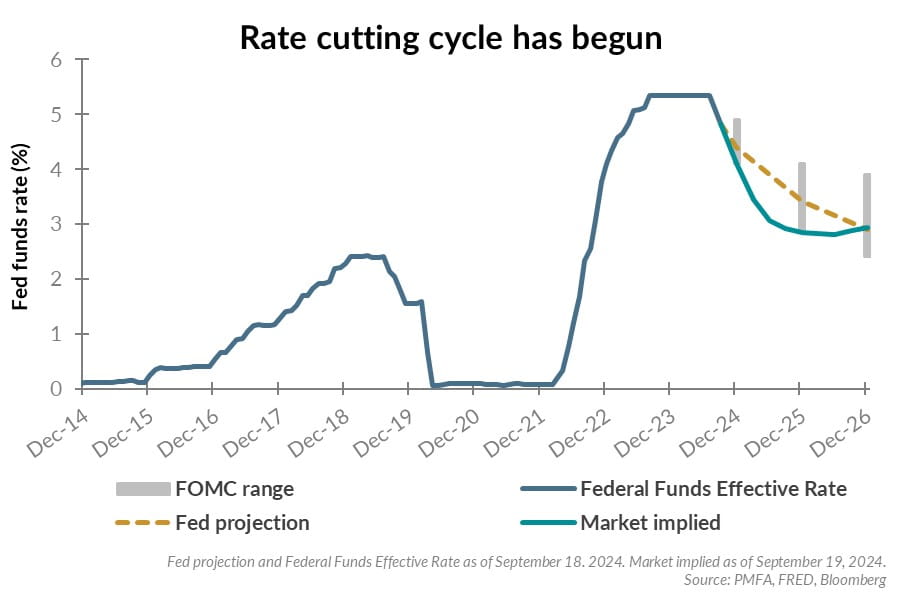

Further, the Fed’s updated projections suggested a greater willingness to trim rates further than previously forecast. Assuming no deviation from those forecasts, another half-percent in cuts by the end of the year now appears likely, with an additional 1% in cuts over the course of 2025. As illustrated in the chart, the markets are pricing in an even more aggressive package of cuts over the next few years. We expect both market expectations and Fed forecasts – as well as the actual path for rates — will continue to evolve. Nonetheless, the Fed sent a clear message about their assessment of inflation risks and their ability to lower rates as a result.

Also noteworthy was Powell’s reiteration that policymakers were increasingly focused on the second pillar in the central bank’s dual mandate (price stability within the context of maximum employment). Perhaps most notably evidenced in the marked slowdown in the pace of job creation and a nearly 1% increase in the unemployment rate since early 2023, the gradual weakening of labor market conditions was consequential to yesterday’s announcement.

The risk in starting with a more pronounced half-point cut was largely one of perception. Would investors, consumers, and economists view such a move as a sign of fear within the Fed that they’d waited too long to act, repeating the frequent mistakes of many of their predecessors? Do policymakers see growing cracks in the economy’s foundation that they fear could lead to recession, necessitating a more aggressive move to stem the tide? Or would the move be viewed as appropriate in response to the continued normalization of inflation data and sufficiently timely for the Fed to avoid falling behind the curve?

Powell conveyed clearly that it was the latter — that policymakers were acting preemptively to cut rates before inflation is back to 2% and before layoffs surged, setting the stage for a soft landing. As the economist Milton Friedman famously noted, monetary policy operates with a long and variable lag.

In simple terms, lower interest rates don’t alter the trajectory of the economy overnight. It takes time – perhaps even a year or more by some estimates — before the full benefit of a rate cut is fully absorbed into the economy. It’s that recognition that led the Fed to move now, even before inflation is back to the central bank’s 2% target, in anticipation of further progress toward that goal.

The uncertainty around timing creates a window of vulnerability for policymakers as they attempt to do enough to relieve their currently restrictive policy while avoiding doing too much, unintentionally putting too much heat back into the economy, potentially unleashing a second inflationary wave. That risk is mitigated though by the fact that policy remains restrictive. Even after yesterday’s cut, the funds rate remains well above the range generally viewed as neutral. The Fed likely has much further to go — perhaps another 1.5-2.0% in potential cuts — to get to a neutral policy range according to their analytical framework and estimates.

If the Fed can get the timing and execution of this easing cycle right, a soft landing for the economy is certainly not out of the question. There are pockets of weakness, perhaps most notably in commercial real estate and manufacturing, the latter of which has been in a modest contraction for nearly two years by some measures. As noted, labor conditions have also cooled. Even so, consumers continue to spend at a decent pace, providing the single most important driver to keeping the economy on track. There are also signs that falling mortgage rates may already having a positive impact on the housing market. Other indicators point to brisk travel activity and restaurant traffic, neither of which would be expected if consumers were cutting spending en masse. To the contrary, various measures of the collective consumer mood appear to be improving, reflective of fading inflation worries and the perception that recession risks have similarly diminished.

That positive sentiment — reinforced by a strong message from the Fed yesterday — has emboldened investors, encouraging risk-taking, and lifting the major stock indexes in its immediate aftermath.

The message for investors

The shift in policy direction should add some wrinkles for investors to consider. For fixed income investors in particular, it’s a clear signal that cash yields are poised to decline, not only in the near term but well into 2025 assuming that the Fed’s projected rate path comes to fruition. As the yield curve returns toward a more normal shape, putting excess cash to work in core bonds should prove beneficial, although some of that benefit has already been priced in. Nonetheless, peak cash yields are now in the rearview mirror, and investors who’ve been sitting on excess cash to benefit from those yields should consider putting that cash to work.

For equities, lower interest rates can help to justify higher valuation multiples and could provide a boost to earnings, particularly for more highly levered companies that would benefit from lower borrowing costs. As is typically the case, current market valuations are mixed, with notable sectoral and capitalization differences. Other factors will also matter, including the rapidly approaching November election. As has been the case in many prior elections, an increase in volatility during the period leading up to election day wouldn’t be surprising, although stocks have typically posted solid gains during the post-election period through year end.

Further, it’s important to note that despite the Fed’s actions, there’s no guarantee that a soft landing will be engineered or that a recession in the coming year will be avoided. Investors should be prepared for the potential that a further deterioration in economic data — even if unexpected — could easily cause a shift in the winds of investor sentiment.

Remaining broadly diversified across global equities and other risk assets, while maintaining sufficient exposure to fixed income and adequate cash reserves, remains advisable within the context of an investor’s personal objectives, risk tolerance, and overarching investment policy.

The bottom line

For now, yesterday’s Fed announcement appears to have been the right decision and the right message at the right time for markets. Whether this positive momentum will be sustained remains to be seen, but for now, investors appear to like what they’ve heard.

It’s far too early for the Fed to take a victory lap, but policymakers have now passed another important checkpoint on the path back to policy normalization, a more benign inflation environment, and a potential soft landing for the economy. As always, if you have any questions, please reach out to your advisory team.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.