The IRS and U.S. state revenue authorities have been increasing transfer pricing scrutiny. These regulators often recast the terms of intercompany arrangements in unintended ways, which can lead to misallocated resources, undesirable terms, or additional income tax with penalties and interest.

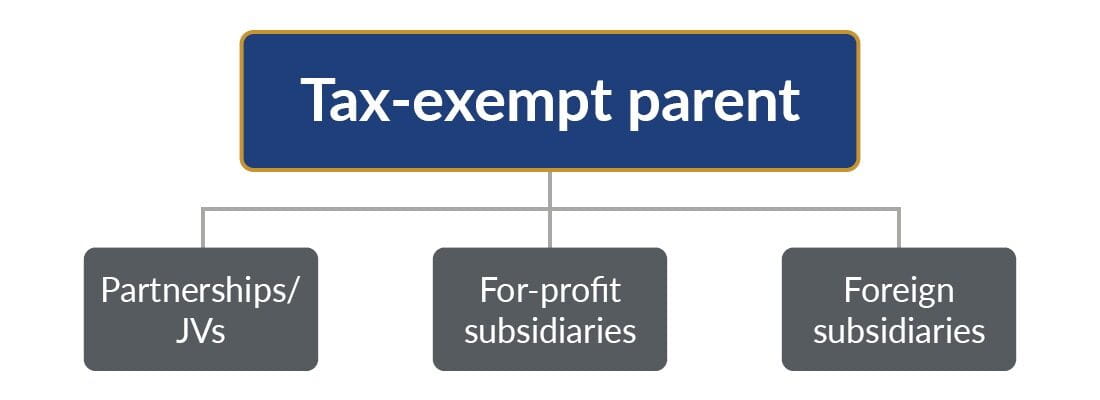

Healthcare system entity structures have become increasingly complicated in recent years to accommodate expanded healthcare delivery models. Structures commonly include a tax-exempt parent entity that holds some combination of partnerships, joint ventures, for-profit subsidiaries (such as taxable C corporations), or foreign subsidiaries.

Among these controlled entities, intercompany transactions need to be treated as if they were between independent parties. This requirement encompasses all types of intercompany transactions, including transfers of tangible and intangible property, the provision of services, and financial instruments.

Services are one of the most common types of intercompany transactions within healthcare organizations. They may include payroll services, overhead allocations, IT support, strategic management, administrative, or marketing.

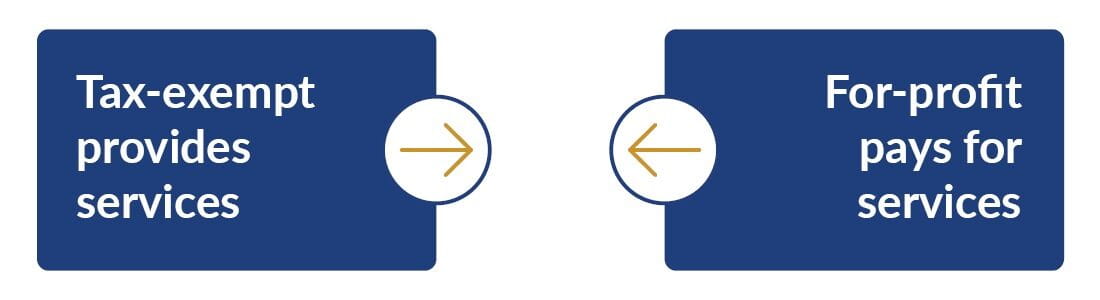

In a common scenario, a tax-exempt parent provides services to for-profit subsidiaries. In this situation, transfer pricing rules require the for-profit subsidiary to make an arm’s length payment to the tax-exempt parent for the services provided. Failure to make an arm’s length allocation of expenses or profits between the entities could result in the financials of the for-profit subsidiary not accurately reflecting income. This means that the for-profit subsidiary could be at risk for underpaid tax, or alternatively, it may be overpaying tax. This may be especially important if the for-profit subsidiary is looking to do business with another company, or if it may be sold because prospective buyers will want the entire financial picture of the cost of doing business.

Unrelated business income: How it factors into your strategy

Unrelated business income (UBI) also needs to be considered in your transfer pricing strategy. Recipient organizations of unrelated revenue from an affiliate must price UBI receipts at market value so the transaction isn’t undervalued, leading to an underreporting of UBI. Similarly, organizations with UBI need to be careful not to overpay for services provided by a related affiliated, which may overstate deductions. Other potential risks include inadvertently creating an excess benefit to related for-profit entities with overly generous payments of compensation or other property, particularly when the payments are made to insiders. Organizations could jeopardize reputational risk because of an IRS reassessment of income tax that may garner significant unwanted media attention.

Using transfer pricing strategically

Beyond risk mitigation, transfer pricing can be used strategically within healthcare organizations. For example, in the case of a tax-exempt entity providing services that qualify under the Services Cost Method, and that aren’t considered UBI, there are potential tax savings. If the tax-exempt entity provides services at cost and no UBI is created, then there is zero tax. The payment for the services is a deduction for the for-profit entity, and therefore, there is a reduction in tax expense. As a result, both entities are properly reflecting the correct amount of income, preserving the tax-exempt status, and reducing overall tax costs.

Is it time to review your policy?

Tax-exempt healthcare organizations aren’t immune to transfer pricing concerns. Whether you’re providing services, calculating UBI, or conducting other intercompany transactions, transfer pricing is a concern. If you haven’t looked at your transfer pricing policy in a while, it may be time for a checkup.