In the transition to electric vehicle (EV) propulsion, vehicle manufacturers are managing out of contracts with suppliers of gasoline internal combustion engine (ICE) components while increasing the purchase of EV-related components. Sometimes this transition happens with the same supplier; sometimes it requires the original equipment manufacturer (OEM) to build relationships with new suppliers — and in many cases both. With finite resources and nearly infinite needs, OEMs and their direct suppliers must adopt a customer-of-choice strategy to ensure a profitable EV transition.

OEM-supplier relationships and the EV transition

The Plante Moran Supplier Working Relations Index® (WRI) is a comprehensive measure of trust, communication, customer support, customer hindrance, and mutual profit opportunity. While historically supplier relationships have been complex, they are growing increasingly so as the industry shifts to EV production.

Today, suppliers provide at least two-thirds of the value of an ICE vehicle. Because OEMs will directly, or through joint ventures, control the production of EV battery systems, power electronics, and electric motors, the percentage of supplier control while the EV supply base is built will slip toward 50%. This presents customers with a conundrum: OEMs must keep their current supply base as allies to feed the production — and profits — of today’s ICE vehicles, while at the very same time, de-sourcing those suppliers on the journey to EVs.

OEMs need to approach this process with more than an “exit” mindset, and they must develop the capacity to build new relationships with critical electronic and software suppliers that have different expectations of the commercial relationship. New suppliers may ask, “Why should I do business with you?” versus a legacy supplier who says, “I can’t afford to lose my business with you.”

Plante Moran WRI 2023 insights into current supplier relationships

The Plante Moran WRI measures supplier relationships that directly relate to the cost, effort, and future opportunity of serving OEMs and foretells the allocation of suppliers’ long-term investments in support of an EV world. Neither the WRI survey nor this article can predict the success of any individual OEM; rather, the WRI takes an industry perspective, using WRI trends and lessons to inform a customer-of-choice supplier relations strategy.

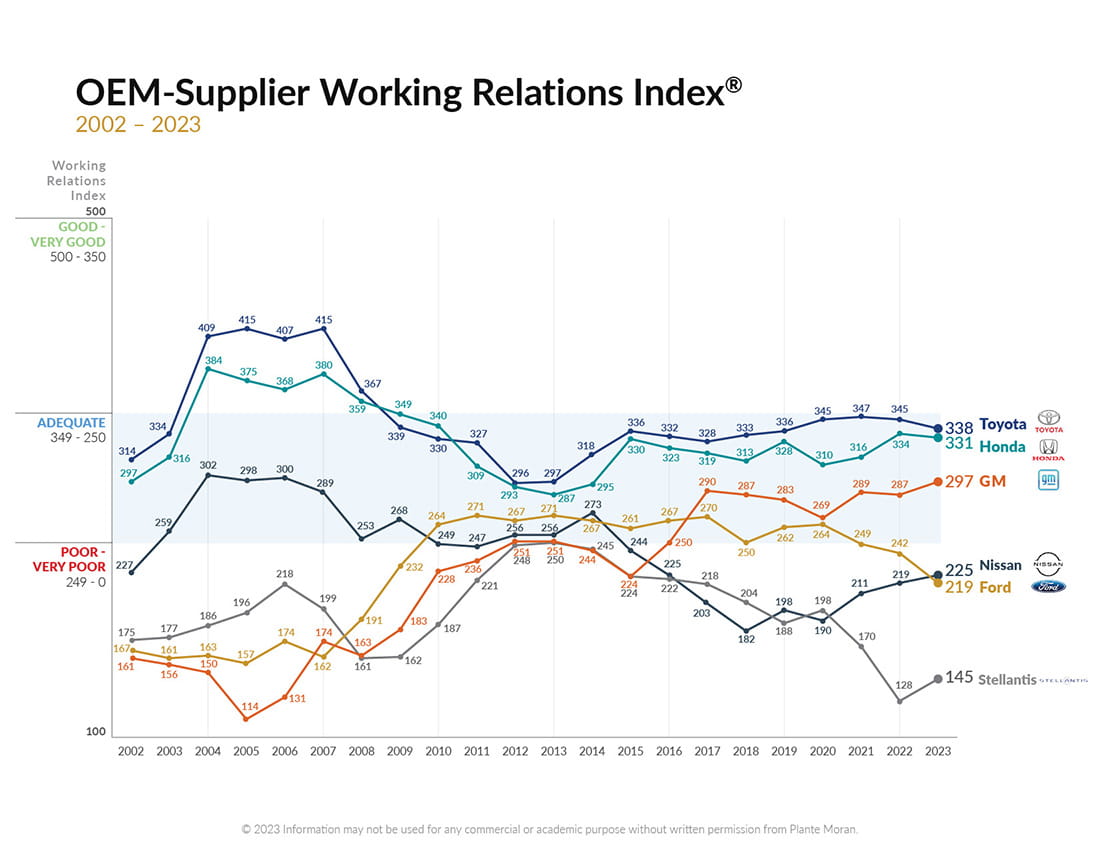

The Plante Moran WRI survey provides a long-term perspective at any point in time of the suppliers’ perception of a customer’s capabilities and capacities to deal with macro- and microeconomic conditions. The survey asks consistent questions to create a standardized index for customer-to-customer and individual year-over-year comparisons. As the image below shows, the entire automotive industry was impacted by the Great Recession of 2008 and 2009. GM and Chrysler were restructured through bankruptcy and a merger. Suppliers went through consolidation. Every company was in the same industry lifeboat, and the difference in supplier relationships across the industry was a narrow 48 points on the WRI.

The 2023 survey, in contrast, now shows a difference in working relationships across the industry of 193 points, the greatest spread in recent history and reflecting the unprecedented complexity a supplier faces working with its OEM customers today. Suppliers needing to adjust to such a wide range of working styles and commercial relationship approaches face potential incremental industry risk — and cost — as they and their customers make decisions to transition their capital and workforce to an EV world.

The WRI trends and absolute survey results behind individual OEM results in the chart below provide lessons the automotive industry should build into supplier relationships to minimize the risk and costs in the EV transition. Beyond automotive, all manufacturers can use these WRI takeaways to facilitate transformation in any industry sector.

WRI lessons related to new EV sourcing and supply chains include:

1. Build commercial trust

Commercial trust comprises three key components:

- Setting realistic expectations — in developing EV program volume forecasts, start and stop of production timing, and other pricing inputs that are highly uncertain.

- Sharing required information — with suppliers, including technology roadmaps, product cycle plans, and sourcing strategies to pull in supplier expertise for components unfamiliar to OEMs.

- Accountability — by improving supplier recovery for stranded investments with no return on investment due to changed customer plans.

2. Create an adequate return on investment on the book of business

Customers need to think about more than piece price in their ROI discussions. Too often, the automatic response is, “We can’t pay more.” But customers can also improve supplier ROI by lowering the cost of doing business. The WRI survey identifies many opportunities for OEMs to lower suppliers’ cost of serving them, including:

- Reducing unnecessary late engineering adjustments. Maximizing the reuse of established ICE platform component designs avoids all new parts for an all-new EV program.

- Improving the timeliness of all decision-making. Reduce management costs and friction to allocate required resources to value-added EV program activity.

- Assuring accounts payable provides the obligated cash flows. Customers using their supply base as a bank increase the risk to the supplier and discourage the supplier from allocating additional resources to the customer’s programs.

3. Reward high-performing suppliers

Customers need to think about a supplier’s entire body of work. Yes, cost, quality, and delivery are core to sourcing decisions. And as suppliers contribute additional “nonproduct” value, sourcing decisions should include more diverse attributes, including:

- Managing and absorbing customer volatile production schedules. As an example, customers need to include the value proposition the supplier provides to the customer’s ICE programs as the supplier’s cost-to-serve calculation is based on one customer, not two.

- Achieving product launch excellence, particularly on a global basis. Customers need to capture the intangibles suppliers provide when launching new technologies that require additional expertise.

- Complying with environmental, social, and governance (ESG) expectations. Delivering ESG requirements to public policymakers, financial institutions, and consumers is an additional supplier cost of doing business that’s not captured in cost models but should be recognized by OEMs with the quality of new programs awarded.

The bottom line

In a time of major industry transition, being a customer of choice ensures OEMs have access to a competitive supply base, particularly for new technologies and materials not part of the OEM’s current supply chain. In turn, creating a customer-of-choice sourcing model is essential to reduce risk and cost through the supply chain to ensure suppliers allocate the financial and human resources and support to achieve the OEM’s long-term strategy.