On Wednesday, Aug. 23, 2023, the SEC voted to approve a new set of rules and amendments to the Investment Advisers Act of 1940. These final rules are a revised version of those initially proposed in February 2022.

The new rules and amendments include the following components1:

SEC-registered private fund advisers

- Quarterly Statement Rule: Requirement to provide investors with quarterly statements, detailing information regarding fund performance, fees, and expenses paid by the private fund, and certain compensation and other amounts paid to the adviser.

- Private Fund Audit Rule: Requirement to obtain an annual audit for each private fund.

- Adviser-Led Secondaries Rule: Requirement to obtain a fairness opinion or valuation opinion for adviser-led secondary transactions.

- Books and Records Rule Amendments: Requirement to retain records to facilitate the SEC’s ability to assess compliance with new rules.

All SEC-registered advisers

- Compliance Rule Amendments: Requirement to maintain written documentation of the annual review of compliance policies and procedures.

All private fund advisers

- Restricted Activities Rule: Prohibition of certain activities that are contrary to the public interest and protection of investors, including2:

- Charging the private fund fees or expenses associated with an investigation of the adviser, unless without disclosure and consent.

- Charging the private fund regulatory, examination, or compliance fees or expenses of the adviser, unless disclosed.

- Reducing adviser clawback by certain taxes, unless the pretax and post-tax clawback is disclosed.

- Charging or allocating fees or expenses related to a portfolio investment on a non-pro rata basis, unless the allocation is fair and equitable and advance written notice compliant with the rules is given.

- Borrowing from a private fund client, without disclosure and consent.

- Preferential Treatment Rule: Prohibition of undisclosed preferential treatment to investors regarding2:

- Certain redemptions from the fund.

- Certain preferential information about portfolio holdings or exposures.

- Any other preferential treatment unless disclosed to prospective and current investors.

Certain aspects of these rules won’t be applied to governing agreements that would need to be amended to comply with the new rules, if the agreements were entered into prior to the compliance date. This treatment, referred to as “legacy status,” is applicable to the prohibitions aspect of the Preferential Treatment Rule and the aspects of the Restricted Activities Rule that require investor consent.

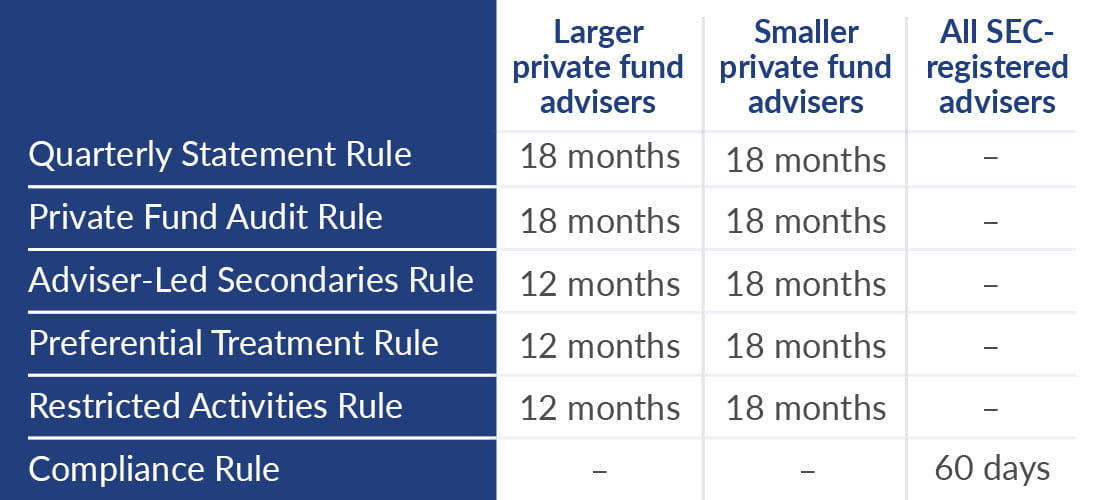

The following table summarizes the effective dates of the new rules. All timelines are from the date the final rule is published in the Federal Register. For purposes of the compliance dates, a “larger private fund adviser” is an adviser with private funds assets under management of $1.5 billion or greater; a “smaller private fund adviser” is an adviser with private funds assets under management of less than $1.5 billion.

Read our article on how new rules impact private equity groups.

Contact our trusted advisors for more insights on how this could impact your operations.

1. The Quarterly Statement Rule, Private Fund Audit Rule, Adviser-Led Secondaries Rule, Restricted Activities Rule, and Preferential Treatment Rule don’t apply to investment advisers with respect to securitized asset funds they advise.

2. These rules are applicable to all advisers that meet the definition of an investment adviser under Section 202(a)(11) of the U.S. Investment Advisers Act of 1940, which aren’t excepted from the definition under Section 202(a)(11)(A) through (E) of that Act.