The long-awaited lease standard, ASC 842, has gone into effect for private companies, and it will impact nearly every manufacturing entity.

While some M&D companies didn’t realize a significant change in their revenue from the adoption of the last major new accounting standard (ASC 606, Revenue from Contracts with Customers), ASC 842 will have a significant impact on any M&D company that has a lease. Here, we share practical approaches and key considerations as you work through implementation.

Identifying a complete population of leases

Sounds easy, right? Identifying leases can be surprisingly challenging since ASC 842 updated the definition of a lease to “a contract, or part of a contract, that conveys the right to control the use of an identified asset for a period of time in exchange for consideration.”

A common place we see leases is within supply contracts that include the use of a specific piece of equipment, a manufacturing line, or refrigerated trucks, as examples. These would meet the definition of an embedded lease.

Embedded leases aren’t uncommon. Take a baking company that contracts out the production of its bread to a co-manufacturer. The volume required, a lack of other bread lines, and time guarantees within the contract mean that the baking company effectively has the right to control the bread line at the co-manufacturer. The use of that line could be considered an embedded lease.

It’s important to note here that ASC 842 didn’t substantially change what an embedded lease is, and the requirement to identify them is also not new. However, ASC 842 certainly increased the importance of identifying embedded leases, since failure to do so can result in a material misstatement.

Discount rate determination

Another key aspect of the new standard is determining the discount rate to use for leases. The discount rate is important because it impacts the lease classification, the amount of asset and liability recorded, and the classification of expense.

Companies often want to default to the incremental borrowing rate in their current bank lending arrangement. However, ASC 842 requires the incremental borrowing rate to reflect the interest rate that an entity would be required to pay to borrow an amount equal to the lease payments on the underlying asset in a similar economic environment. As a result, in nearly all situations, entities will not be able to calculate a single incremental rate and apply it to all leases. Instead, manufacturers need to determine the incremental borrowing rate for each lease based on the terms of the lease and the nature of the leased asset.

To simplify implementation for private companies, FASB created a practical expedient to elect to use the risk-free rate that corresponds to the term of the lease. This certainly simplifies the rate determination process, but the risk-free rate is likely to be significantly lower than the entity’s actual incremental borrowing rate. As a result, electing this practical expedient may result in a significant increase to the recognized right of use asset and lease liability.

Many entities were reluctant to elect to use the risk-free rate due to the significant impact to the balance sheet. In response, FASB issued an update that provides more flexibility to utilize the practical expedient by asset class rather than entity level.

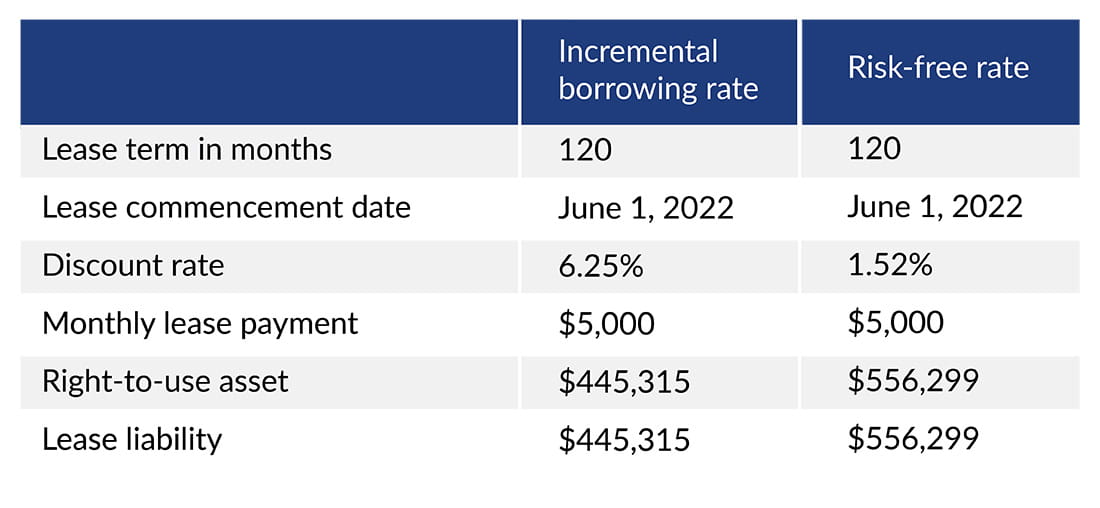

To illustrate the impact of the risk-free rate, consider this simple lease example and the significant impact on the right-of-use asset and liability as a result of the differing rate.

The key takeaway: carefully consider your approach. There is almost always a trade-off by using the simplicity afforded by the practical expedient.

Making a lease management software decision

We’re frequently asked questions about whether or not a lease management software solution is required to implement ASC 842. Our perspective is that this will depend on a number of factors including, but not limited to, the number and complexity of leases within your lease portfolio, the capacity of your accounting team, effectiveness of the current method, industry-specific needs, internal control considerations, integration needs, lessor versus lessee perspective, etc.

While there will be a cost associated with lease management software, it will in many cases simplify the effort to analyze and implement the new standard as well as establish a process for future lease tracking.

Changes to related party leases under ASC 842

Related party leases often have terms that are inconsistent with market terms. The old lease standard required that leases were accounted for based on the economic substance rather than the legal substance. Under ASC 842, related party leases are now required to be accounted for based on the legally enforceable terms of the contract.

This change could have significant impacts on leasehold improvements and the underlying amortization period. Under the old standard, there could be a built-in assumption that the lease would just renew for, as an example, 15 years despite being a one-year lease with no renewal options due to its related party nature (substance over form). As such, leasehold improvements were depreciated over that 15-year period.

Under the new standard, the lease term is only based on the legally enforceable terms, which in this example would be one year. The lease term and leasehold improvement lives need to align, which results in a significant acceleration of deprecation. Related party lease terms should be carefully evaluated and may require modification and/or formalization.

Reconciliation to lease expense

The required lease disclosure includes a reconciliation to lease expense. This has resulted in the need to prepare a lease roll-forward, an exercise that companies have likely not performed historically. The reconciliation can highlight things such as a population of leases that were deemed immaterial for purposes of implementation but together cause significant reconciling items.

What if related party leases exist among a consolidated group? Maybe there’s a net-zero impact if all activity is eliminated upon consolidation. However, if supplemental schedules are presented that show consolidating impacts, the impact of ASC 842 will still need to be presented and then eliminated.

Financial reporting objectives and lease negotiations

Companies can negotiate different lease terms to achieve desired financial reporting objectives. For example, if your goal is to minimize the balance sheet impact, negotiate net leases that are shorter-term.

If your goal is to maximize EBITDA, negotiate longer-term gross leases that would meet the financing lease classification.

Of course, it’s most important to make decisions that are right for the business — don’t let the accounting tail wag the business dog.

Impacts on covenants

The impacts of ASC 842 implementation can have unintended consequences on financial metrics such as those set forth in bank covenants. For example, how does your bank agreement define debt in your debt-to-income ratio? Does it include leases? If so, the implementation of ASC 842 will have an impact on this metric. It’s important to understand the implications and have proactive discussions with lending institutions to minimize inadvertently violating loan covenants.

ASC 842 post-implementation

The new leasing standard contains many technical nuances. The time is now to work through implementation. Be sure you understand the requirements and their implications for your supply contracts, technology decisions, financial reporting, and debt covenants, among (many) other considerations.

Then, once you’ve implemented the lease standard, you’ll need to continue to monitor compliance for new leases or modifications to existing leases. We assure you, adjustments will be needed.

If you have any questions, feel free to contact our team. As always, we’re happy to help.