The Consolidated Appropriations Act (CAA), enacted in December 2020, expanded and modified many important benefits initially introduced in the Coronavirus Aid, Relief, and Economic Security (CARES) Act enacted in March 2020. Companies may significantly benefit from revisiting provisions that were initially limited but now have greater reach, particularly the employee retention credit (ERC). The American Rescue Plan Act of 2021 (ARPA), enacted in March 2021, further enhanced and extended the applicability of the ERC, but a provision in the Infrastructure Investments and Jobs Act subsequently accelerated expiration of the ERC from Dec. 31, 2021 to Sept. 30, 2021 for most employers.

As originally introduced, the ERC provided qualifying employers the opportunity to claim a 50% refundable credit based on up to $10,000 of payroll costs for qualifying employees (i.e., a maximum $5,000 per employee credit) provided various requirements were met. However, companies were restricted from claiming any ERC if they also obtained a loan through the Paycheck Protection Program (PPP). The PPP had the potential to be fully refundable (becoming the economic equivalent of a grant) and could potentially offset far more than $5,000 per employee. Therefore, it’s unsurprising that many companies opted to pursue a PPP loan and forego opportunities to claim the ERC.

A significant change under the CAA was to allow companies that obtained a PPP loan to also retroactively claim the ERC for qualifying expenses during 2020, but only with respect to payroll expenses not funded with forgiven PPP loan proceeds. In addition, the ERC was further expanded to allow for additional credits (70% of up to $10,000 payroll costs for qualifying employees per quarter) to be claimed in certain circumstances for each quarter of 2021.

In light of these legislative changes, significant opportunities may exist for companies that:

- Might otherwise have opted not to pursue claiming the ERC in 2020 or 2021 to revisit their eligibility.

- Claimed the ERC in 2020 to determine whether additional credits are available given the relaxation of various rules.

Following are some key considerations that companies, with the assistance of their advisors, should consider when assessing ERC opportunities:

Was the business “fully or partially suspended” due to a governmental order during any quarter of 2020, and/or 2021?

As one of the paths to claiming the credit is to have had a suspension of business operations resulting from a government order, companies should identify the actual order and governmental branch or agency that issued it and assess that it did, indeed, require their operations to be suspended. Further, where a business reduced or modified its operations in response to an order, an analysis should be performed to determine whether such modification had a more than nominal impact, and as such could qualify as a “partial suspension” of the business.

Was there a “significant decline” in gross receipts in any quarter of 2020 or 2021?

An alternative path to ERC eligibility is to show a significant decline in revenue versus a comparative quarter in 2019. Analyzing whether this condition is met could involve some unanticipated complexities, including determining what streams of income constitute gross receipts for purposes of the ERC and, in the instance of a business that has related entities, determining at what level businesses should be aggregated for purposes of determining the gross receipts decline.

- For the 2020 ERC: If the gross receipts of any quarter in 2020 were less than 50% of the corresponding quarter of 2019, the ERC is available in that quarter. The ERC is also available in each subsequent quarter of 2020, until the end of the quarter when gross receipts were at least 80% of the corresponding 2019 quarter. Modified rules apply to businesses that began operations sometime during 2019 and for businesses that were acquired during 2020.

- For the 2021 ERC: If the gross receipts of any quarter of 2021 are less than 80% of the corresponding quarter of 2019, the ERC is available in that quarter, and eligibility continues until the end of the quarter when gross receipts were at least 80% of the corresponding 2019 quarter. Businesses may elect to use the gross receipts from the prior calendar quarter for this test. For example, to determine ERC eligibility in Q1 of 2021, the business may compare its gross receipts from Q4 of 2020 to those from Q4 of 2019. Additionally, businesses that weren’t in existence in 2019 may compare their 2021 gross receipts to the corresponding quarter of 2020.

Were the average monthly full-time employees (FTEs) in 2019 greater than 100 or 500?

The ERC in 2020 has tighter restrictions for companies that had more than 100 full-time (working over 30 hours per week or 130 hours per month) employees in 2019, while the 2021 ERC has comparable restrictions for companies that had more than 500 full-time employees in 2019. In particular, for those companies, the ERC is limited to situations where employees were paid while not actually performing services, or where health insurance premiums were paid for employees not otherwise receiving wages (i.e., furloughed employees). Thus, the full-time headcount impacts the credit available in 2020 and 2021 but is based solely on the employment numbers from the 2019 measurement period. Determining whether the “100 full-time” or “500 full-time” employee count threshold is crossed may be complicated by situations where the business entity is related to other entities and, in combination, they may exceed this threshold. The actual determination of full-time employees may also be complicated in situations where there were seasonal employees or significant changes in headcount during 2019.

What payroll costs were paid with PPP loan proceeds and to what extent were those proceeds forgiven or expected to be forgiven?

The CAA modifications to the ERC are designed to prevent claiming a credit where the payroll expenses are paid from forgiven loan proceeds (i.e., avoiding “double dipping”). Careful analysis is needed to trace the use of forgiven (or expected-to-be-forgiven) PPP loan proceeds and to determine the portion of ERC-qualifying payroll costs that weren’t funded with such proceeds.

Other areas bringing added complexities for which companies may benefit from assistance include:

- Analyzing the impact of acquiring or disposing of a business during the credit eligibility period (or the 2019 comparative period)

- Coordinating an ERC calculation and claim with other federal benefits, e.g., the Families First Coronavirus Response Act (FFCRA) paid leave

- Amending payroll tax returns (Form 941) for relevant quarters to claim the ERC

Employee Retention Credit (2020)

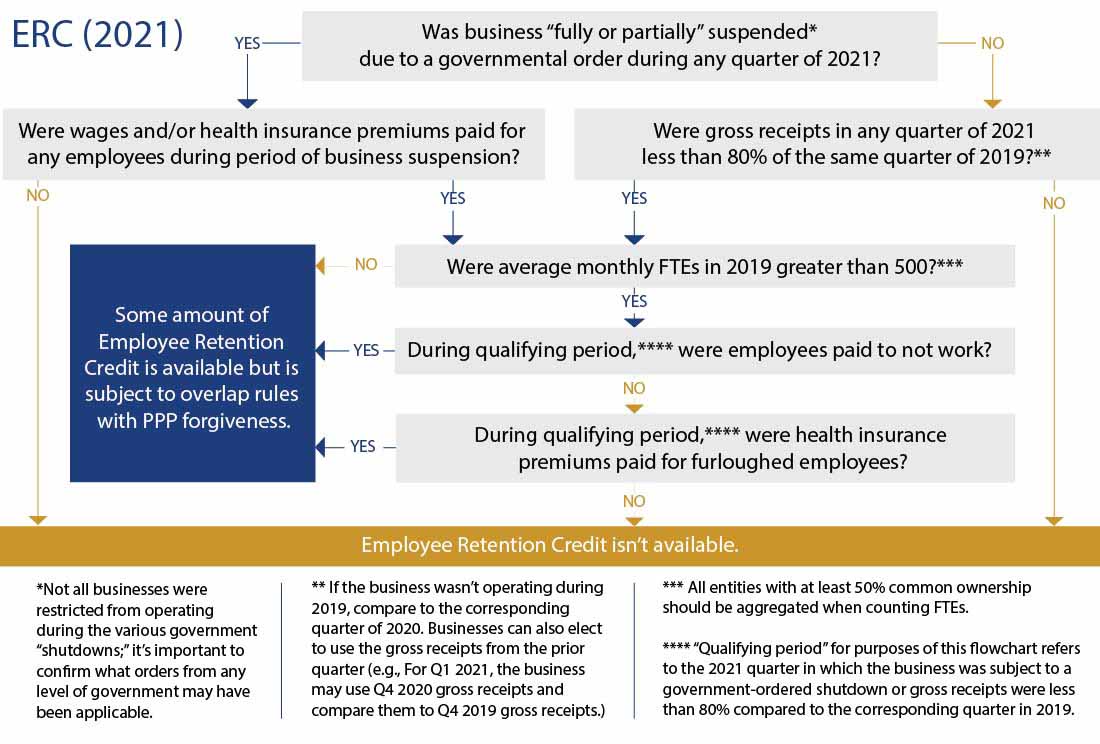

Employee Retention Credit (2021)

The Consolidated Appropriations Act, enacted in December 2020, expanded the scope of the Employee Retention Credit and now permits qualifying taxpayers to claim the ERC in 2021, irrespective of whether a credit was claimed in 2020. While this is an expansion of the program initiated in 2020, there are new rules that apply specifically to 2021. This flowchart is meant to assist in identifying when the ERC may be available; it’s not a substitute for robust analysis and calculation.