The decline in equity markets experienced in the first quarter of 2020 related to the COVID-19 pandemic was one of the swiftest in market history. Investor patience was tested, and despite a strong rally, concerns remain today about how markets and the global economy will behave going forward. Although the duration of equity bear markets has historically been much shorter than those of bull markets, the magnitude and velocity of losses can be unnerving, causing some investors to question their investment strategy. Is there anything that could be added to portfolios that might help to protect portfolios during such downturns, while also providing the opportunity to make appropriate long-term returns? We believe alternative investments are worthy of consideration.

We tend to differentiate “alternatives” from traditional investments if the investment strategy ultimately provides exposure to something other than diversified, long-only, and common stocks, bonds or cash. Put simply, alternatives are “different” than traditional asset-class exposures, and thereby may provide diversification benefits to a portfolio. Manager selection is critically important in the realm of alternative investments, as dispersion between top- and bottom-performing managers has typically been wider than in traditional asset classes. This is attributed to the fact that many alternative investment strategies, by nature, don’t intend to deliver performance in line with widely cited market indices. Instead, they seek to rely on their skills, resources, and ownership of unique assets to generate differentiated returns.

Allocating to alternative investments as a part of strategic asset allocation can help to reduce portfolio volatility and improve investment returns through enhanced portfolio diversification. However, alternative investments can also underperform traditional investment strategies for extended periods, as witnessed in much of the last decade. We believe that alternative investments, while an excellent option for many clients, aren’t necessarily appropriate for every investor, regardless of the size of their portfolio. Allocating to alternative investments might prove better as an investor-by-investor decision.

This commentary is intended to dive deeper into hedge funds, one of the main categories of alternative investments, and will define four major types of hedge funds and highlight some structural differences when compared to traditional investment strategies.

A little background on hedge funds

“Hedge fund” is a broad term for a privately offered vehicle that pools capital for investment purposes. Hedge funds aren’t a new phenomenon. It’s often cited that the first hedge fund was opened by A.W. Jones & Co. in 1949. According to Preqin’s 2020 Global Hedge Fund Report, the hedge fund industry has grown to over $3.5 trillion of assets under management as of November 2019, spread across more than 16,000 active funds.

Hedge funds are offered through private fund structures that aren’t widely available to the public. This structure allows them to offer more flexible, less-constrained investment strategies relative to traditional vehicles such as mutual funds, because they aren’t subject to the same regulations. In fact, to invest in a hedge fund, one generally must be an accredited investor (and/or qualified purchaser), which requires having a minimum level of income or assets. Typical investors in hedge funds include foundations, pension funds, and wealthy individuals.

Hedge funds tend to utilize a broader set of investment techniques like short-selling (discussed further below) and leverage when compared to more traditional investment managers. These techniques may allow them to generate unique return streams that could result in portfolio diversification benefits. These techniques may also increase the amount by which a hedge fund may underperform or outperform broad market benchmarks such as the S&P 500 Index (this performance differential is called tracking error). Investment concentration is also commonly witnessed in hedge funds, as many managers tout having research expertise in a given strategy type or sector.

Most hedge funds trade in marketable securities that are liquid and priced frequently, but some do invest a portion of their funds in illiquid assets. Because of the prevalence of liquid securities, hedge funds are generally known as “open-end” funds, meaning that investors may request liquidity under normal market conditions at varying intervals (e.g. quarterly, annually, etc.). Given the active nature of hedge funds, tax complexities are often greater than those associated with traditional investment vehicles.

Hedge fund performance

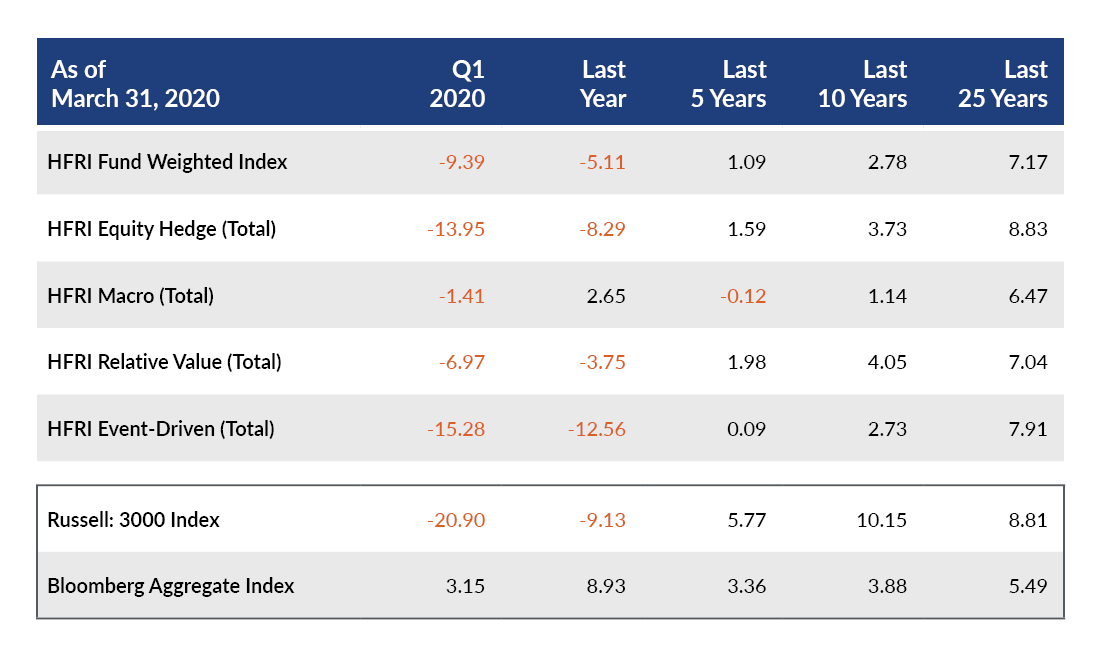

Most hedge funds employ investing techniques that aim to reduce the sensitivity, or correlation, of their performance to traditional market indices. This can be especially beneficial in a period like the first quarter of 2020, which was a relatively weak period for equities. The table below shows that the HFRI Fund Weighted Index, which is a highly cited index for broad hedge fund market performance, was down 9.4% for the quarter ended March 31, 2020, compared to the Russell 3000, which was down nearly 21%.

There has been significant dispersion in recent periods among the four main hedge fund substrategy types, which fall under the HFRI Fund Weighted Index in the table below. During the first quarter of 2020, all hedge fund strategy types outperformed the Russell 3000, but some substrategy types provided more downside protection than others. This dispersion emphasizes the importance of “knowing what you own.” Dispersion among hedge fund substrategy types is reduced considerably over longer hold periods.

The chart above also highlights that hedge funds have underperformed stocks and bonds over many of the longer-term periods shown. The period since the Global Financial Crisis (GFC) of 2008/2009 was especially difficult for the average hedge fund manager to perform in line with traditional asset classes. This is largely due to the tailwind provided by highly accommodative central banks, which increased investor risk appetite and depressed market volatility, which reduced the opportunities for active managers to add value over standard investment approaches. Bonds also performed very strongly during this time period as interest rates decreased consistently throughout the period. Hedge fund performance should be expected to lag in exceptionally strong bull markets, as strategies that aim to offer downside protection to investors often do so at the expense of upside market participation. Anyone considering alternative investments should have an appropriately long-term time horizon, as investor patience may often wane at the wrong time — typically when traditional equity performance is strong. During 2019, when equity markets were up over 30%, many investors questioned why they own hedge funds, as the HFRI Index was up “only” 10.50%. However, the first quarter of 2020 highlighted the diversification benefits of hedge funds and their potential to reduce investment angst when fear and uncertainty are high.

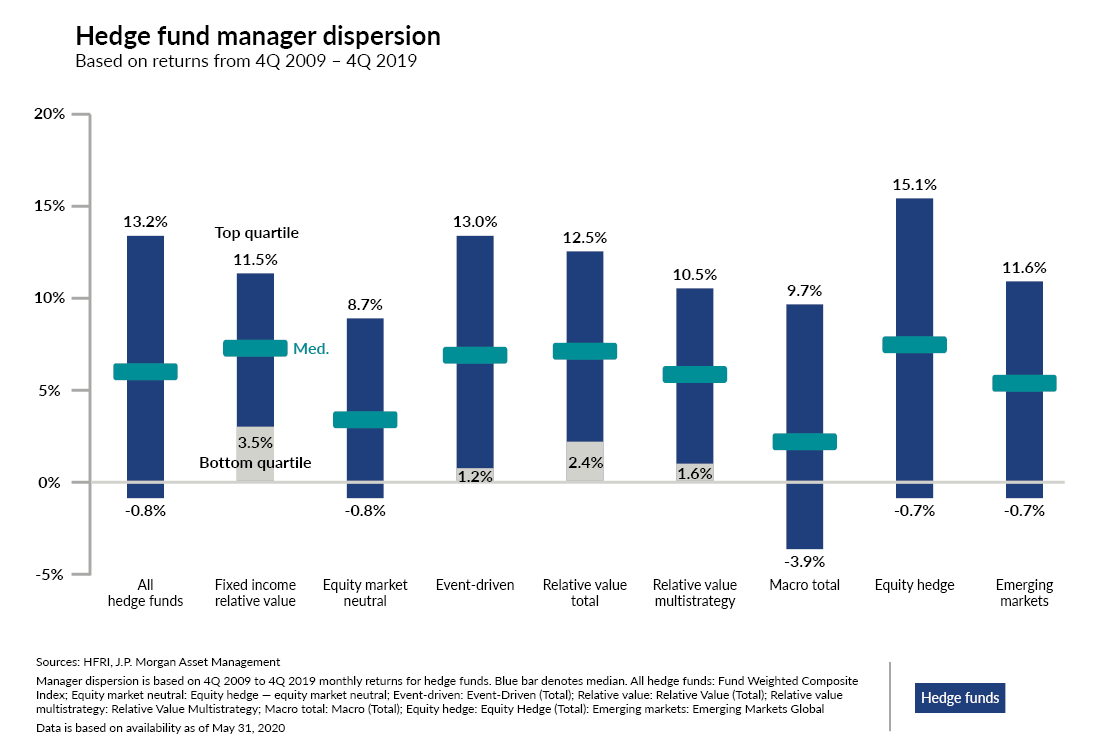

It’s important to remember that the performance of hedge fund indices, such as those cited above, reflect a sort of “average” performance experience. Individual hedge fund manager performance will vary dramatically within each category, and there are managers that did perform strongly during the bull market following the GFC. The chart below shows representative manager dispersion for the 10-year period ended Q4 2019, within both the broad hedge fund universe (first column on left) as well as within detailed subset of hedge fund categories. Investments in top quartile managers would have generated returns that closely matched or outperformed equities, as well as outperformed bonds. And many would have done so with less volatility than equities. So, while investing in “average” hedge funds can provide portfolio benefits, investors who can access top performing funds have a better opportunity to improve portfolio returns while lowering volatility when compared to more traditional strategies.

Hedge fund strategy types

Equity hedge

Equity hedge funds, also referred to as long/short equity, invest a portion of their portfolios in “long” equity positions that will profit if stock prices appreciate, while also investing in “short” equity positions, which will profit if stock prices decline. Managers of equity hedge funds typically have strong equity research backgrounds, so many will emphasize certain sectors in which they have the most investing experience. Leverage is commonly utilized to magnify returns.

Returns of equity hedge funds are expected to move in a similar direction as equity markets, but the magnitude of movement will vary across individual funds depending on portfolio positioning and individual stock performance. Positive equity market correlation typically allows equity hedge funds to outperform other hedge fund strategy types in strong equity markets, while causing underperformance during weak equity markets. Relative to traditional long-only equity mandates, equity hedge will typically outperform when equities decline but will often underperform when equity markets experience strong upside. While these are general statements that apply to the universe, any individual hedge fund must be analyzed to understand how it may behave in various market environments.

Macro

Another strategy type that has historically performed well during equity market declines is macro. A very diversified strategy group, macro strategies range from discretionary strategies, which position themselves based on a manager’s top-down view of the world, to commodity trading advisors (CTA), which position themselves according to the output of sophisticated computer models that seek to take advantage of evolving trends in markets. What macro strategies typically have in common are that they position themselves with little regard to individual security viewpoints and are often positioned to benefit from a few key themes, which can provide unique sources of return. These attributes can make macro strategies attractive diversifiers to traditional investment mandates during periods of market turbulence, like the first quarter of 2020.

Macro managers can struggle to navigate market environments that are different from those seen historically, as their “models” don’t necessarily know how to account for them. For example, in the past decade, the significant amount of central bank stimulus and its impact on market direction, which often reversed course dramatically in short periods, caught some macro managers off guard, resulting in periods of lackluster returns.

Relative value

Relative value is another hedge fund substrategy type that also employs long/short trading. However, trades are usually executed across a wider range of securities and with a higher degree of leverage than is seen in most equity hedge strategies. In addition, unlike equity hedge strategies, which will generally retain positive equity market correlation, risk management of relative value strategies may aim to reduce market correlation to virtually zero. Some of these strategies are referred to as “market neutral” and have the potential to be excellent diversifiers.

Relative value strategies typically perform well when there is high variability of returns among the securities and instruments they trade (high dispersion), while performing poorly when short-term market volatility spikes and securities all trade in the same direction (low dispersion). These strategies are highly dependent on the manager’s skill and risk management capabilities, and because of their use of leverage, may show wide performance disparities.

Event-driven

Another major hedge fund substrategy type is event-driven, which refers to strategies that aim to generate returns largely from the realization of specific corporate “events” (e.g. mergers, bankruptcy, restructuring, etc.). While equity hedge managers would also need to have views on corporate events, (as these would be influential to stock prices), event-driven managers are different as they may invest in debt securities, typically have longer investment time horizons for each position owned, and may invest in illiquid securities to a larger degree than equity hedge managers.

Hedging (or shorting) isn’t as common in event-driven funds as it’s in other types of hedge fund strategies. In addition, owning securities that face potential challenges, like bankruptcy or restructuring, can punish even-driven strategies in a bear market as investors seek safety and certainty. This was certainly the case in the first quarter of 2020. However, since it’s a more equity-sensitive strategy, event-driven tends to perform better than other hedge strategies when sentiment recovers, as investors feel comfortable increasing risk.

Interestingly, while event-driven managers showed the worst performance of the strategies discussed during this recent market downturn, we believe they may offer one of the best areas of opportunity in today’s environment. Many of these funds invest in distressed credit, a type of event-driven strategy. Given the evolving stress that the COVID-19 pandemic is exerting on the global economy, many businesses may have to modify their existing capital structures or be forced into bankruptcy. While there are event-driven hedge funds that may invest a portion of their assets in these more illiquid types of securities, there are also “closed-end” funds that specifically invest in these distressed situations. Closed-end funds, unlike hedge funds, traditionally do not allow for any voluntary investor liquidity over their duration, which typically ranges from five to 15 years. This allows a manager flexibility to execute their strategy without the fear of needing to respond to investor redemption requests. We will discuss these more illiquid types of strategies in a future article.

Conclusion

The breadth of the alternative investment toolbox, which includes hedge funds, can be valuable in helping to increase portfolio diversification and improve investment returns during bear markets. However, these same strategies may result in underperformance during strong bull markets. Hedge funds come in a wide variety of risk/return profiles, so understanding what to expect from a given manager under various market conditions is critical. Understanding how your portfolio may perform in the short run (with or without hedge funds) is critical to maintaining confidence in a long-term investment strategy. Hedge funds can help improve overall portfolio performance, but they are not for everyone. In addition to meeting income and assets requirements, investors need to be comfortable with the additional complexity, lack of liquidity, costs, leverage, and increased tax-filing requirements that may accompany such strategies.

If you’re interested in learning more about alternative investments and whether they could play a role in your portfolio, please reach out to your client service team.