Looking around, you know your campus is out of date and perhaps a little worse for wear. But don’t slap on a new coat of paint or knock down some walls just yet. Before you decide to embark on a capital project, we recommend completing an investment appraisal (also known as a capital budget).

Capital budgeting involves gathering and evaluating key information about your senior living organization’s physical condition and financial situation. Performing this analysis will help you determine whether you need — and can afford — a capital project. In addition, it provides the metrics needed to develop a sensible project plan that ensures you’re making the best decision for your organization’s future.

Step 1: Determine your facility’s condition

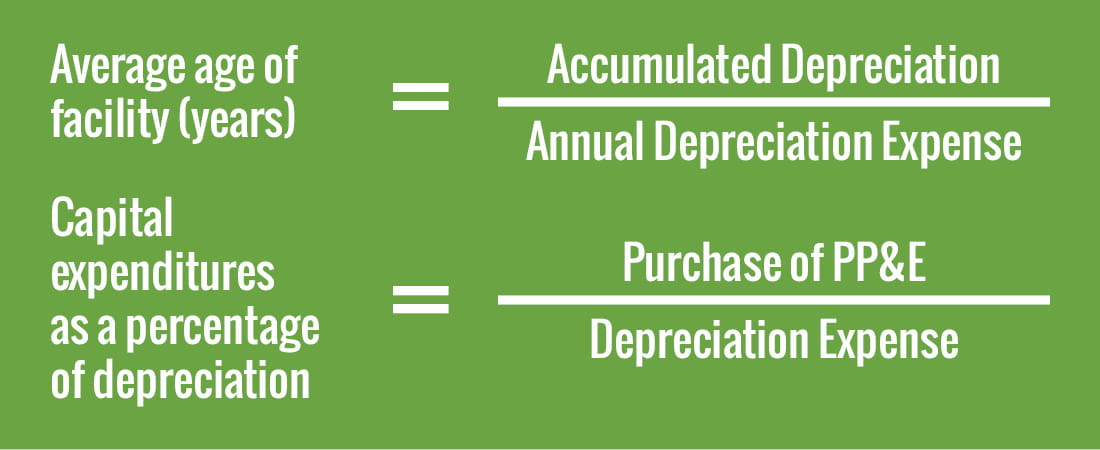

Quantifying the physical condition of your facility is the essential first step to gaining perspective on your current situation. The capital expenditures ratio and the facility’s age are the primary financial indicators of the physical condition of your campus. To determine the age of your facility and your capital expenditures ratio, use the following equations:

These numbers are necessary to compare your situation and facilities to your competitors’, which leads us to the next step in the capital budgeting process.

Step 2: Compare to available benchmarks

Compare your metrics to industry benchmarks to draw attention to where you may be falling short of competitors. Benchmark comparisons generate more meaningful discussions with stakeholders as you consider the need for a capital project.

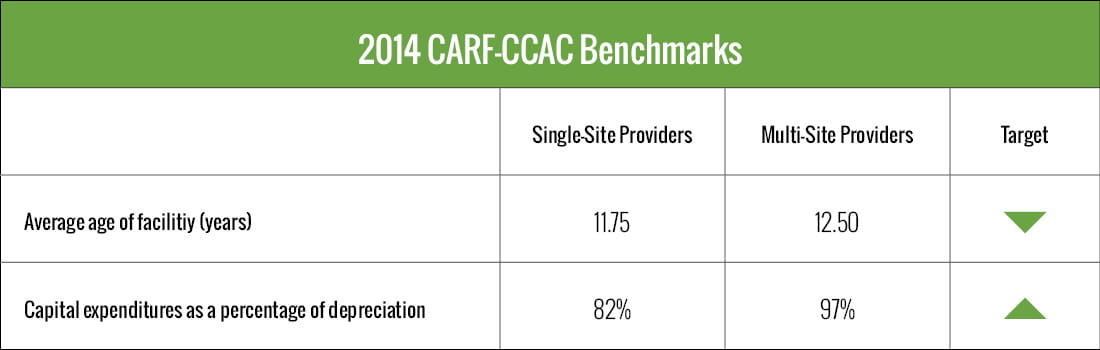

In the chart below, we provide the 2014 CARF-CCAC benchmarks for single- and multi-site providers.

Compare your numbers from Step One to the benchmarks. If the average age of your facilities is higher than the benchmark or your capital expenditures ratio is lower than the benchmark, then a capital project may be in your organization’s future.

Step 3: Assessing the feasibility of a potential project

If your organization appears to be due for a capital project based on the above calculations, don’t contact the architect or general contractor just yet. (In fact, first contact an experienced team like Plante Moran Living Forward to help guide you through the proper planning phases for your proposed project.) There are a few vital questions you must consider first:

- What is happening in my market? What are my competitors doing and how do we compare?

- Is a new line of service, major repositioning, or large-scale renovation feasible?

- How much can I really afford to spend on a capital project?

- What renovations are necessary to bring my facilities up to snuff?

It is imperative that you properly assess your financial position before moving forward with a project. We cannot stress this enough. Conducting a financial analysis prior to the design can save your organization time and money in the long run by helping you define a reasonable financial scope for your project. In addition, calculating your maximum debt capacity as part of a financial analysis provides the starting point for answering these questions during discussions with your stakeholders and potential lenders.

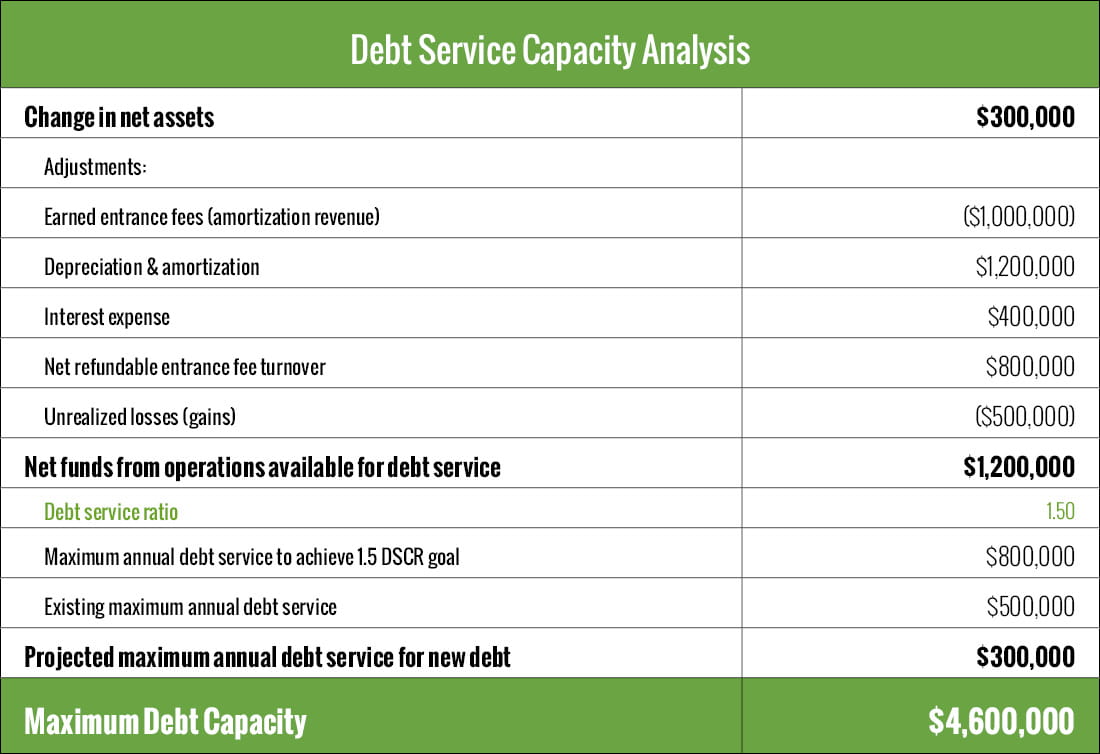

As an example, let’s say you are a provider that generates $300,000 of annual net income. To determine your debt capacity, you would use the method described below, which measures debt capacity from a lender’s viewpoint by including adjustments for noncash transactions available and used during operations to determine the net funds you have available for debt service. Adding back these noncash transactions gives you — and more importantly, lenders — a clearer picture of the full amount you have available to pay the debt.

Now that you know what is available to cover your debt payments (in our example, $1.2 million), you must calculate how much debt you can afford. First, you need to determine your debt service coverage goal. This is the number of times your funds available can cover your debt payments. Typically, the goal will be around 1.35-1.50. Next, determine the maximum annual debt service to achieve your debt service coverage goal by dividing the funds available ($1.2 million) by the goal (1.50). To determine the maximum annual debt payment for a new project, you will need to deduct your current debt payments from the maximum annual debt service. The maximum debt capacity available for a new project is based on the present value of the maximum annual debt service for new debt, along with assumptions for the interest rate and term of the proposed debt.

Step 4: Making an informed decision

Now you know what you can afford and are ready to choose a project. At this point, we recommend running a scenario analysis to assess which projects may be successful and worth analyzing further before making a decision. The scenario analysis, in conjunction with an in-depth market study and the financial feasibility analysis from above, will ensure you choose the best project for both your organization and your community. If you’re working with a firm like Plante Moran Living Forward, providing your historical and year-to-date financials enables us to perform the scenario analysis, or we can review the analysis performed by your organization.

Key takeaways

Following these steps before committing to a capital project can help you avoid common mistakes and unnecessary expenses. But don’t feel like you have to go it alone — bring in specialists to help step you through the nuances of these capital budgeting analyses and put your options into perspective within the larger market in which your organization resides.

Plante Moran Living Forward has helped facilitate capital planning discussions for many assisted living, independent living, memory care, and skilled nursing facilities, and we would be glad to help yours as well. If you would like to learn more about our services, please reach out to our team.

If you'd like more thought leadership like this delivered right to your inbox, sign up for our emails: